Articles & News

Market Report

Single-family sales sizzle

Published: 04.18.2024

In the movie Field of Dreams, the hero hears a voice that says, “If you build it, they will come.” That is reminiscent to the way we could describe the Lake Martin real estate market—“If you list them, they will sell.” For over two years, reduced inventory has resulted in lower overall sales volumes. We have long believed increases in inventory would result in increased sales. Sales results for the last 12-month period confirm that belief.

Our focus for this month’s report (click here for previous reports) is on single-family waterfront homes. The year-over-year sales volume for the 12-month period ending on March 31, 2024, increased 12.4% to $281,209,647 over that same period last year. Total unit sales, which have been lagging as mentioned above, increased 4.5% to 201 units sold.

We still think there is room for growth. The total number of homes sold was 210 units for the last year. That was nine houses over last year’s number. That result is impressive since there were only 314 houses listed last year versus 321 for the prior year.

After subtracting units sold and properties pending closing, that leaves us, as we head into the summer sales season, with just 81 properties left to sell across 880 miles of shoreline. With the current sales pace, that leaves us with only a 4.63-month supply. If more properties are brought to the market, we believe that we could help more people find a lake home.

Property values continue to rise as well. The average single-family home sales price for the most recent 12-month period increased 7.6% to $1,339,094. This is a trend that has continued since March of 2019, when the average price was $705,642. That is a 90% increase in average sales price over a five-year period.

Driving factors

We think that there are factors beyond inflation that have driven property values to historic highs. First, we think that property values were below their intrinsic value after the financial crisis. Sales prices remained low for an extended period, due to tremendous inventory levels and tight credit standards.

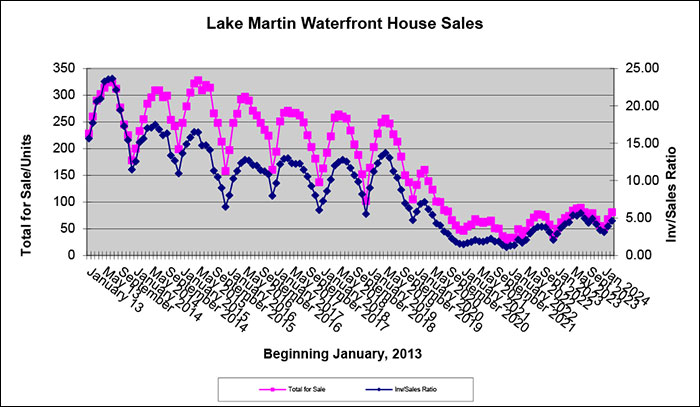

The chart below shows the inventory levels. As you can see, inventory levels reached 350 units (as shown in pink) for sale in 2013 and remained stubbornly high until 2019. The inventory-to-sales rate (as shown in blue) also remained elevated after hitting 23-months’ supply in 2013.

In 2019, the available inventory numbers began to reach a healthier level. Then, COVID occurred. With COVID, people reassessed their lives, and Lake Martin was rediscovered. What they found was a beautiful lake in a rural/peaceful setting with expanded amenities. This created a much-increased demand that has driven sales prices and volumes upward.

What to look for

What we have observed around the lake is cautious development activity coupled with increased amenities. These two factors have restrained inventory while providing an improved lifestyle. Prime examples of added amenities include Russell Crossroads, new marinas, and, of course, Wicker Point Golf Club and the soon-to-be-completed Benjamin Lake Club at The Heritage.

Finally, we think that, as long as interest rates stay elevated, many people who have locked in 3% fixed-rate loans on a vacation home are not likely to put that property on the market unless, of course, they want to take a profit. What we have noticed is that most people love their lake place too much to part with it. That is a good thing.

If you want more detailed information regarding the market, our Sales Executives have data on the market and how to take advantage of the opportunities that are available today. Reach out to them at 256.215.7011 or send them an email to find out more.