Articles & News

Market acceleration slows

Published: 11.23.2016

Key metrics settle on a healthy plateau

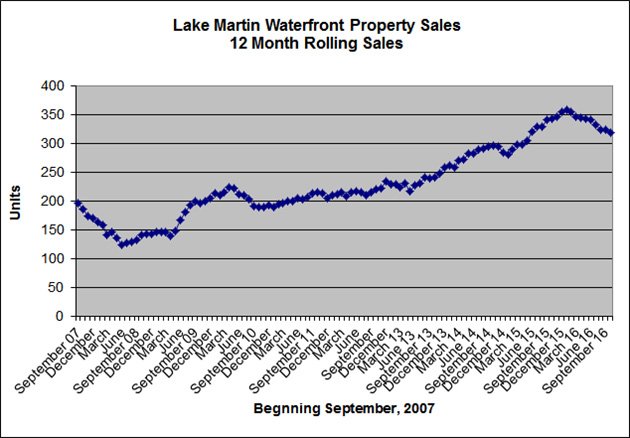

What a ride! After a prolonged market slide beginning in 2008 and ending in 2013, we have experienced a rapid climb for waterfront property sales and values. This climb began in 2014, rapidly accelerated in 2015, and has finally leveled off in 2016.

It is interesting to do a “look back” at the numbers. For the twelve months ending this October, the overall market volume for residential real estate was down 9.6% compared to the same period last year. But that was compared to a year where the market rose like it was powered by rocket fuel. The sales volume for 2015 increased 33.33% over 2014. 2015 was a pretty big comparable to attempt to match.

So, we were off a little. But, to give a little perspective of exactly where we are now, we ought to look at where we have been. This year’s sales numbers are 28.4% higher than 2014 and 48.07% higher than 2013! That is a pretty significant increase. In fact, 2016 sales ranks as the third-best year of real estate sales in the history of Lake Martin, with 2006 and 2016 coming in first and second, respectively. (See chart below.) If 2017 promises to be like 2016, we will take it!

While gross sales values have dropped, average sales prices have more than held firm, year-over-year, with median prices actually increasing by 3.5% for lake homes. Undeveloped lakefront lots have increased in value an average of 13.2% year-over-year as well. This tells us that, if the market has leveled off, it certainly has firm footing in its valuation.

If you keep up with our monthly market report, you might recall our prediction that gross sales numbers were likely to slip this fall, and that average values could or should continue to increase. The reason for this prediction was the reduced inventory of available properties on the lake. In all property categories–lake lots, condos and single family detached–the amount of available inventory has decreased. Residential supply is 8.6% lower than last year, presenting fewer options to potential purchasers.

A smaller supply with equal or greater demand is going to cause prices to rise. While we see a slightly smaller demand, the supply of attractive lake property continues to contract, leading to an increase in property values.

Market Prediction

We predict that the market will continue to perform well into summer of 2017. Sales numbers for the first quarter could actually be higher than the same period last year. Sales agents reported a slow-down in activity due to the election. If that is true, then those delayed purchases will likely occur prior to the beginning of the spring lake season.

Property prices are likely to increase due to the lack of attractive lake homes. With lot supply diminishing, the value of lots will increase further. Lower numbers of lots and homes may lead to a lower number of transactions and greater competition to purchase fewer properties. Lake listings typically increase around the first of February. Interested buyers are advised to shop early to get the best selection and pricing.

And an off-the-topic tip!

Lake levels have dropped to winter pool levels. For those needing to install seawalls and piers, get with your contractor soon. Some contractors have several months of backlog in work orders.